Why invest in the Water Industry?

- Starting point can easily be that Water is the commodity which will never be obsolete due to its form factor and how it is being consumed unlike oil & electricity industry.

- After doing a rough research to lay down foundation for further investment thesis on the water industry, the best position would be to focus on household names within this industry because it is seen that despite water industry holding such an essential role in our economics, they are less covered by advertisers or discussed in news outlets compare to Apple or Google. Thus, making it difficult for new investor to locate these stocks for its portfolio.

- American Water Works (NYSE: AWK) and Aqua America (NYSE:WTR), which are the two biggest water utility companies in the U.S

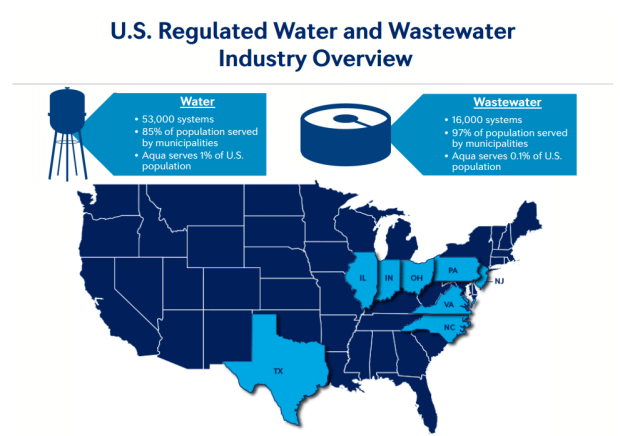

The water and wastewater industry is the nation’s most fragmented utility industry. The great majority of the U.S. population is served by municipal drinking water and wastewater systems. Approximately 53,000 water systems and more than 16,000 wastewater systems exist in the country. Even though roughly half of the drinking water systems are privately owned, they serve only about 15 percent of the population. Approximately 20 percent of the wastewater systems are privately owned, but they serve only about 3 percent of the population. More stringent regulations from federal and state environmental regulators, and the capital needed to meet such standards on the part of many system owners, as well as the monetizing of public assets to support the financial condition of municipalities, are among the factors that might drive consolidation. The U.S. Environmental Protection Agency has estimated that an investment of $335 billion is needed for required improvements to the nation’s aging water infrastructure over the next 20 years. While the American Society of Civil Engineers has estimated that $298 billion is needed to improve the nation’s wastewater infrastructure.

In nutshell from Aqua water’s statement (above), we can conclude that market outlook looks to have enough potential for expansion since the companies in the industry can look to expand water services to more residential and commercial regions along with scoring contracts with public authority to manage water and replace outdated wastewater system.

AQUA AMERICA (NYSE: WTR)

- Founded back in 1886, is the publicly traded holding company for regulated water and wastewater utilities that serve approximately 3 million people and growing with their growth strategy

- Region covering: Pennsylvania, Ohio, Texas, Illinois, North Carolina, New Jersey, Indiana and Virginia

- Company completed more than 200 acquisitions of utility systems in the last 10 years

- Services provided include repair, inspects, clean waterline and sanitary wastewater lines.

- Supports municipal authorities as well as regular households

From reviewing the financial statements, it is clear that WTR has been steadily increasing revenue for the past 10 years. Most notably aspect is the increase in debt from their annual reports. According to the company, they are using the debts to obtain more water and wastewater systems as followed by their growth-through-acquisition strategy.

AQUA AMERICA’s GROWTH STRATEGY:

“Aqua looks to capitalize on its core capabilities, which include prudently investing in infrastructure, consistently earning credibility with our stakeholders and maintaining our status as one of the most efficient utilities in the nation. This strategy directly and positively impacts the communities we serve. Our employees’ expertise and the company’s financial strength allow us to prudently analyze and competitively bid for utility systems, especially those that have neglected to invest in infrastructure over time. The company has completed more than 250 utility system acquisitions in the last 15 years. In 2015, Aqua’s growth-through-acquisition strategy yielded the largest customer growth rate seen since 2008. The company’s successful growth initiatives included four municipal acquisitions, which contributed to a 1.9 percent customer base increase. A 1.5 to 2 percent increase is anticipated by year-end 2016. In 2015, Aqua invested approximately $365 million to improve its infrastructure systems. The company expects to invest more than $350 million in 2016 and more than $1.1 billion through 2018.”

Reasons to Invest:

Here are few reasons for investors to consider before including WTR to their portfolio:

- Water: it’s a commodity that will never be obsolete and there are no replacements for water in form factor compared to electricity or oil or other type of energy for consumption usage.

- Climate Changes: Rain has been falling less in several regions in the U.S and due to that new innovations will be required to move water to water deprived states.

- Dividend Power: WTR has increased their dividend for 26th time in 25 year and 2016 marked the 71st consecutive year of paying a quarterly dividend. This sits well with current shareholders.

- Stock Performance: WTR has outperformed the S&P 500 since IPO execution in early 1980s.

- Growth Potential: Projected growth rate for the next 5 years is 5.25% which is better than several other utilities companies, which falls in the average growth rate of 4.2%

- Market Capture: WTR has a huge market according to the chat below, they have potential to expand operations by penetrating in drought stricken states such as California & Southern States.

- Marco Impact: Water utility companies are recession proof because even doing market turmoil, people will need to consume/use water.

Risk Profile:

- Sole Growth driver: WTR drives growth through acquisitions and upgrades; this is a potential risk because having only one source of growth going forward could mean company may face difficulties in growing if debt gets expensive or no cash to acquire small utility systems.

- Management Concern: There is a lot to understand about the management structure of the WTR because poor management could corrupt business practices & damage shareholder value.

- Debt issue: The Debt to Cash is significantly high, as currently WTR has 1.8B in debt and only 3.2 million in cash. Hence, if company is hit with any micro/marco level shocks, dividend payments would suffer.

American Water Works:

While American Water Works has not been public company as long as WTR, it has grown rapidly to be considered the largest water utility company in the U.S. The company serves approximately 15 million people across more than 40 states and two Canadian provinces. Similar to WTR, AWK also focus on acquisition tactic for growth.

Financial Summary:

Comparing the financials with WTR, both companies have similar outlook as revenues have increased for past couple of years along with gradual increase in debt burden, allowing company to have little cash reserve. The total debt for the company stands at 6.2B v the cash of 66M.

Reasons to Invest in American Water Works:

Important to note that American Water works has same benefits as WTR in terms of reasons to invest, however there are few others that separate them from their competitors, which also include WTR.

- Experience with desalination: this could be a key expertise in drought regions for expansion as AWK can provide drinkable water through synthesizing ocean water.

- Dividend: AWK has increased its dividend since 2008 IPO

- Stock performance: AWK stock has outperformed S&P 500 by 183.99% since 2008

- Growth: Projected growth rate for next 5 years is between 7-10%

- Investments: AWK has heavily invested in new technology, especially in smart water grid management which helps them being more reliable and efficient in the industry

- AWK has 5 U.S patents and more than 80 competitive research grants.

Hence, these competitive advantages will help AWK stay ahead of the other water utility companies.

Risks:

The set of risks are similar to the WTR. However, they will need more resources to drive the growth past 2020 & poor management could potentially impact stock performance.

Conclusion:

It can be said that both WTR and AWK are in good position to capitalize to grow its market based on the water and wastewater system in the U.S. However, the fragmented US water market is in need for consolidation in the wake of limited access to financing. For example, the funding allocation for clean water fell from US$2.1B in 2010 to US$689 million in 2013 and this could be seen as a potential obstacle for private companies to grow beyond certain level. And investor should focus on investing in these stock for long term returns along with applying fair value mechanism in deciding whether the stock is overvalue or not.