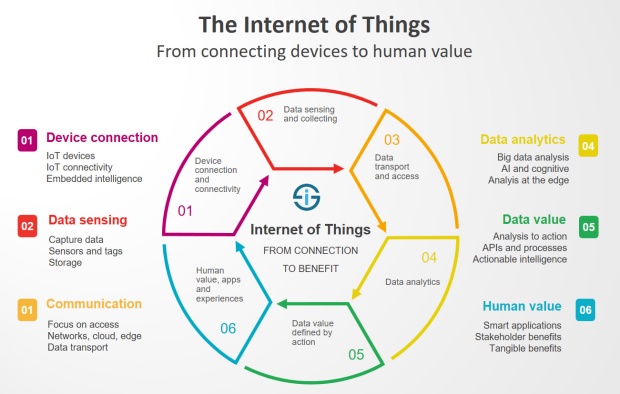

The Internet of Things (IoT) can be explained as a way to connect everyday appliances like homes, industrial equipment, watches, etc to the internet, for the purpose of tracking usage, collecting data and automating systems. The IoT connectivity is expected to hit 50 billion objects by 2020 with $7.1T valuation by that same year.

Current use of IoT in the companies:

Company IoT Focus

Apple Smart watches

Alphabet Smartwatches, Nest, Andriod Things, Google Home, Google cloud IoT services, Weave platform

General Electric Predix software, Asset Performance management software, IoT security monitoring and Brilliant Manaufacturing software.

Verizon Communications Smart city connections, ThingsSpace platform, asset tracking and management, smart device monitoring, 5G wireless

The impact of IoT is not limited to a particular sector, as there are telecom companies already building Internet of Things networks that are designed specifically to bring low-power devices online. Tech firms pushing for virtual assistants that are helping to connect IoT devices to each other and car makers are pushing for driveless cars with help me small IoT comopanies to make their plans into reality.

Worldwide spending on IoT is predicted to reach $1.4T by 2021, according to IDC (the Motley Fool, LLC)

Companies likes Amazon (NASDAQ: AMZN), Skyworks Solutions (NASDAQ: SWKS) and Verizon Coomunications (NYSE: VZ) are already making big investments in the IoT spcae, with aim to gain benefits for years to come.

Best Stocks in IoT 2018

Verizon Communication: The connectivity play

With being positioned as the nation’s leading wireless service provider, the company has made a couple of strategic IoT acquisitions over the past several years, including Fleetmatics and Telogiz. these takeovers helped Verizon boost its telematics business (connecting cars and fleets to the internet), which generated $220 million in the Q3 2017 & grew 13% y/y. Despite the fact that telemetics numbers seems far less than other revenue streams Verizon has, but the telemetics market is expected to grow into an $18.4B industry by 2022, with Verizon has an early lead in the space. Apart from telemetics, Verizon is expanding its IoT presence through its LTE Cat-M1 network- this is specifically designed for IoT devices and the development of its 5G network. The LTE Cat-M1 network was the first of kind to launch in U.S. last year, and it gives the company the option to sell cellular connectivity for low-power, low-bandwidth devices, from water meters to wearable tech devices for consumers.

And Verizon is also conducting more tests of its 5G wireless network, which will be used to connect more IoT devices and could be used to navigate telematics space. And investors should take notice of Verizon’s annoucement to lauch 5G network in the selected cities this year, allowing them to have a kick start in this space.

Amazon: The IoT cloud and device play

Amazon has entered the race through its latest product; Echo devices, powered by the voice assistant Alexa. Echo devices account for about 70% of the smart speaker market right now, and there is plenty of evidence indicating that 2018 will bring more growth for sales of such devices as RBC Capital is already estimating that Echo devices could add atleast $10B to Amazon’s top line by 2020. But Amazon is not only solely focused on smart speakers (Echo) but also keen on extending IoT through Amazon Web Services- its cloud computing segment, which is on the forefront of this space as well, suggested by the data that Amazon is already a cloud computing leader with 40% of the market.

The underrated company within IoT: Skyworks Solutions

Skyworks is a chipmaker that used to only focus on selling its products/components to large mobile device manufacturers like Apple and Samsung. But the company expanded into IoT components that connects cars to the internet. The company is banking on the fact that more semi-autonomous driving components are being added to the vehicles, and that automakers and tech companies will rely on wireless connections to update the software that controls them. For instance, Tesla, already sends over-the-aire updates to its vehicles. Skyworks, IoT chips can already be found in Amazon’s Echos, Hyundia’s connected cehicles, and smart-home lighting technology by Cisco Systems.

Quickly breaking down Skyworks revenue segments, it earns around 26% of its top line from non-mobile revenue, with 22% y/y growth in recent quarter. Skyworks has already proven that it can be a primary supplier for major tech and automotive companies, which should put company in a great position once market starts to adapt more IoT devices and connected vehicles hit the market.

Investment strategy: Go Long

While Amazon, Skyworks and Verizon are in great position to reap the IoT space benefits, investors should understand that they need to play the long-game in this market. For instance, Verizon will roll out 5G network slowly, and its telematics business will take time to grow. Skyworks is earning significant revenue from its IoT components, but it still relies mostly on its chips sales for mobile phones. And Amazon is acting rapidly within its IoT devices and AWS IoT services, but its other AWS services provide majority of the company’s profit.