The biotechnology industry is constantly reinventing itself, but one of the biggest noises over the last couple of years has been the introduction of biosimilar drugs to the U.S markets.

Biosimilar: Background

Biosimilar drugs are derived from Biologic drugs that are made by a living cell, typically an engineered bacterium or yeast, with collection of compounds from animals such as cows, mice, rabbits, goats and even humans, according to Mary Wahl, who works at Microsoft. This makes them substantially more difficult to manufacture and impossible to make an exact replica unless a company follows the exact same manufacturing procedure as the company that makes the brand-name drug. Meanwhile, small-molecule drugs (which generics mimic) can be easily synthesized by chemicals in a consistent process by the manufacturers as to make sure that drug has same effective profile every time. One expert told Fortune, if small-molecule drugs are a tricycle, biologics are space ship. Biologic drug, despite its complexity can help with lots of various conditions in the body, like monoclonal antibodies to fight cancer or Neupogen to enhance white cells during chemotherapy treatment.

Therefore, “Biosimilar” term is coined because changes in cell lines, growing conditions, expression times, purification process and several other variables can have minor changes on the drug being developed. Hence, biosimilar candidate is similar but not identical to the brand-name drug it is trying to copy cat.

Due to the complex process, FDA had previously been reluctant in allowing these to be marketed or sold in the USA- giving biotech companies free pass in stacking up billions in profits from the clinical drugs even after their drugs lost patent protection, as there was no clear competitor. However, that all changed in 2010 after passing of the Affordable Care Act, known as Obamacare, as the bill cleared the pathway for biologics to finally reach U.S. consumers. Ultimately, last year, the FDA gave the green light to the first biosimilar drug, and that opened the flood gates for more biosim candidates.

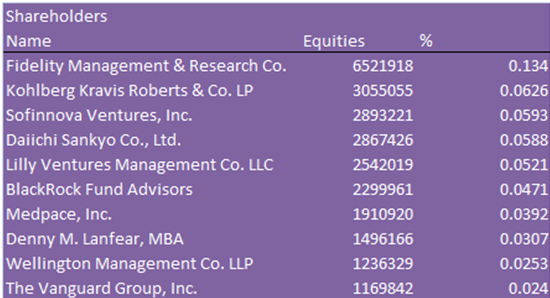

One small-cap company that is looking to cash on the Biosimilar trend is Coherus BioSciences Inc (NASDAQ: CHRS). That engages in the development and commercializition of biosimilar therapeutics worldwide.Its clinical-stage pipeline consists of two anti-inflammatory agents targeting tumor necrosis factor, a substance in the body that is involved in the inflammatory response; and a long-acting form of granulocyte colony-stimulating factor, a beneficial substance in the body that stimulates production of granulocytes (a type of white blood cell) in order to promote the body’s ability to fight infections.The company was founded by Dennis M. Lanfear and Stuart E. Builder in September 2010 and is headquartered in Redwood City, CA.

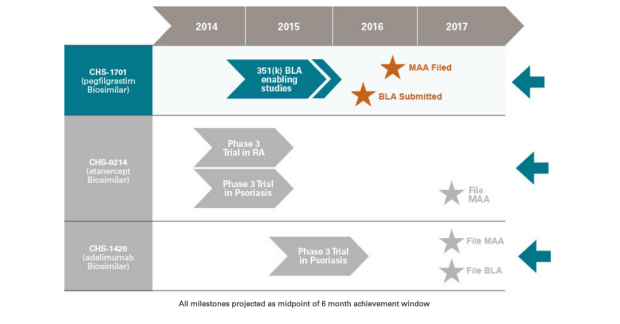

While there are several companies focused on creating biosimilar drugs, Coherus BioSciences Inc (NASDAQ:CHRS) is a dark horse, that demands attention from the investors. The company has three crucial biosimilar product candidates, which are CHS-1701, a biosimilar version of Amgen’s (NASDAQ: AMGN) white blood cell boosting drug Neulasta® (Sales of Neulasta® were more than $4.5B in 2015, so even if Coherus could capture a portion of that market away from Amgen, that will be enough to turn this small-cap biotech company into profitable flight). CHS-0214 the copy-cat version of Enbrel as well as CHS-1420 that is targeting AbbVie’s Humira.

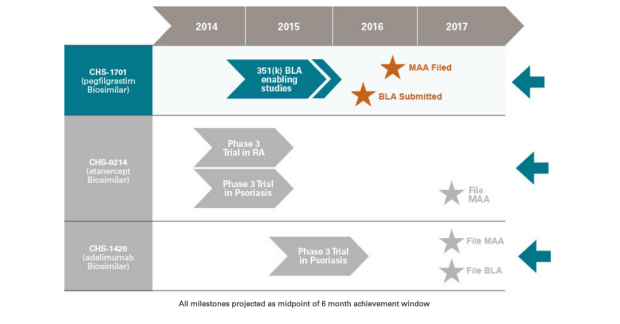

At the J.P. Morgan Healthcare Conference in January 2017, Coherus presented its key milestones for 2016 and ensured that it is on track to submit all three of its biosimilar candidates (mentioned above) for regulatory approval during this year. Subsequently, confirming CHS-0214 submission for regulatory approval in the 2H of 2017, along with FDA decision date of June 9th 2017 for biosimilar candidate of Neulasta and BLA acceptance for Humira’s biosim later this year. Henceforth, these developments at Coherus indicates that the company could be less than a year away from generating powerful revenues if they could successfully navigate the products through the regulatory process and market their copy-cat Biosimilar versions effectively.

In regard to the execution/marketing of the products, Coherus has wisely aligned itself with deep-pocketed players such as Baxatla and Daiichi-Sanyo, which should make it easier for it to launch the products if they to find their way to market.

Candidate Developments:

Product 1: CHS-0214

Coherus and Baxalta (NYSE:BXLT) announced at the Conference that CHS-0214, the biosimilar version for Amgen’s Enbrel met its primary endpoint in phase 3 trial- confirming no clinically significant difference between CHS-0214 and Enbrel. Previously, CHS-0214 has successfully completed two phase 3 studies, one in chronic plaque psoriasis,with data being released in November 2015, and the other one in rheumatoid arthritis,data released in January 2016. The data from phase 3 studies along with two pivotal clinical pharmacokinetic studies focused on supporting the MMA.

Product 2: CHS-1420

In another recent Phase 3 trial readout, Coherus’ biosimilar CHS-1420 showed similarity to AbbVie’s Humira in psoriasis patients. Start of this month, Coherus announced that CHS-1420, (a therapy candidate for plaque psoriasis) the biosimilar candidate of adalimumab (AbbVie’s Humira ®), met the primary endpoint in a clinical pharmacokinetic (PK) bioequivalence study that compared CHS-1420 to Humira in healthy subjects. Previously, the phase 3 trial illustrated that CHS-1420 showed similarity to AbbVie’s Humira in psoriasis patients along with similar safety profile as both drugs were well-tolerated. Management anticipates filing of Biologics License Application (BLA) for CHA-1420 to be accepted by FDA this year.

Product 3: CHS-1701

Last year, Coherus reported top-line results, indicating that the study met all of its co-primary endpoints from its follow-on Pharmacokinetic and pharmacodynamic (PK/PD) clinical study of CHS-1701, a pegfilgrastim (Amgen’s Neulasta ®) biosimilar candidate. Moreover, the safety profiles of CHS-1701 and Neulasta were also considered similar, with no serious adverse event during the study or clinical testing. And recently the commercial plans along with preparations have began, with FDA approval expected.

But it would be wrong to conclude that Coherus BioSciences wholly depend upon those three biosims, just because these products cover large market opportunity. Coherus is much more when we add in the potential Coherus phase 1 product candidates. These include biosimilar versions of in-demand chemotherapy drug, Avastin (GENENTECH INC) and wet age related macular degeneration drug Lucentis (GENENTECH INC), each of which currently generating billion in annual sales.

However, the small biotech faces challenges as it is involved in legal litigation with not only AbbVie for Humira but recently Amgen also took Coherus to court over Neulasta’s biosim. These lawsuits could potentially delay the products from reaching the market within the timeline Coherus has anticipated. Plus, making biosimilar is still significantly expensive and complicate procedure, meaning copycat biosim players only undercut their branded counterparts by 15%-30% along with the lengthy timeframe of actually availing the benefits. For example, in 2009, Novartis launched a Neupogen biosim, and it took four years for that product to overtake the sales of original drug. Therefore, it is essential to investigate the cash in hand held by such biosim companies before investing. And in Coherus case it is well financed right now, with more than $155million as of Sep. 2016 and previously in March 2016, it raised additional $72million from a common share offering. Meaning plenty of capital to advance its candidates along the regulatory phase and be able to stay firm during any upcoming potential setbacks (i.e lawsuits or clinical data failures).

How big is the Biosimilar trend?

The biosimilar wave, according to Citigroup is around $110Billion opportunity over the coming decade. And one might speculate on dumping brand name producing drug companies like Amgen or Celgene as this wave will crush their prospects. But even these biotech companies, specifically Amgen has been heavily investing in creating its own biosimilar pipelines in an effort to capture & capitalize with nine biosmis in development phase. According to the Amgen, the worldwide sales of branded drugs copy-cat biosim version currently exceeds more than $52billion. Three other household names that are heavily investing in this space are Pfizer (with purchase of Hospira), Novartis’s Sandoz unit and Biogen, who has a partnership with Samsung to develop biosimilars.

Investment analysis:

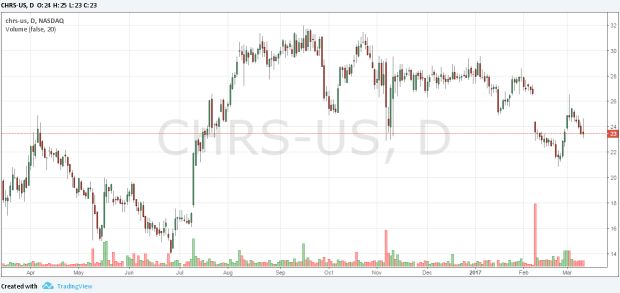

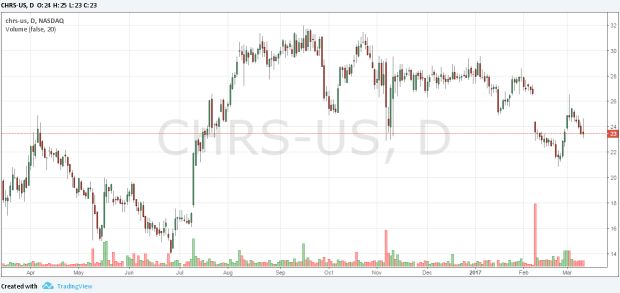

Coherus BioSciences shares fell -2.291% to close the day at $23.45 on 9th march 2017. And as of September 2016 earnings report, the Enterprise Value (EV) stood at $1,110.9million with EBITDA at $87million along with $1.93 EPS. The highest price CHRS shares have touched in last 12 month was $31.98 and the lowest price hit in that time frame was $14. Price target is an essential factor while computing the analysis of a stock.

Technical analysis glimpse:

Moving averages are used as a strong indicator for technical stock analysis and it helps investors in reflecting where the stock be heading. Using this tool for CHRS, the 200-day moving average price is $27.78 and 50-day moving average is $25.23.

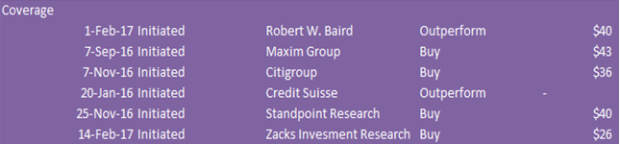

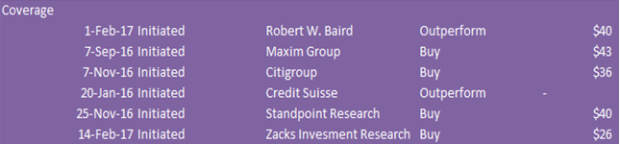

According to 7 analysts, Price Target for CHRS is $46 highest, $38 lowest and $41.14 being the average floating stock price.

The data below illustrates the recommendation trends:-

CHRS performance during the last 12 months improved by 65.78%, while it’s YTD performance was hit by a negative trend of -11.55%, with stock falling -14.87% over last 6 months along with significant drop in the stock price in the January. The financials suggest a strong long term outlook for the CHRS with Sales Q/Q at 2172%, EPS Q/Q 187.70%, ROE 414.30%, ROI 3533.30% and ROA -47.10%.

Investors who succeed in the small-cap biotech market have learned to temper their expectations. Only a small number of these companies succeed, and the constant chance of a big drop is tough on the stomach lining. The San Francisco-based Coherus Biosciences (NASDAQ:CHRS) is a good play for those who believe the biosimilar industry should start breaking out in the next 12 months. Coherus’ stock has been on the rise since reporting positive data for its biosimilar for Amgen’s Neulasta in July 2016. Coherus submitted a biologics license application (BLA) for its Neulasta copycat in August. Since Amgen’s drug generated almost $4.8 billion in sales last year, it’s reasonable to assume that this biosimilar could achieve at least $1 billion in annual sales along with 2 other blockbuster biosims ready to be launched in the USA market.

Coherus Biosciences Inc (NASDAQ:CHRS) is scheduled to be posting its quarterly earnings results after the market closes on Monday, March 13th. Analysts expect Coherus Biosciences to post earnings of ($1.11) per share for the quarter.